Department Of Revenue Florida

Florida Dept. of Revenue - Florida Dept. of Revenue

Beginning October 1, 2021, Florida businesses will be required to report new hire information for independent contractors to the Florida Child Support Program. To learn more about the requirements, read section 409.2576, F.S. The Department of Revenue Child Support Program provides a variety of ways to report, including online and by mail or fax.

https://floridarevenue.com/

Department of Revenue - Florida

The Department of Revenue (DOR) provides critical services to millions of individuals, businesses and families throughout Florida, including general tax administration, child support services and property tax oversight. DOR employees are located in offices throughout Florida and the U.S., with opportunities ranging from entry-level to senior ...

https://jobs.myflorida.com/go/Department-of-Revenue/2817500/

Florida Dept. of Revenue - Home - floridarevenue.com

In Florida, local governments are responsible for administering property tax. The Department of Revenue's Property Tax Oversight p rogram provides oversight and assistance to local government officials, including property appraisers, tax collectors, and value adjustment boards. About Us.

https://qas.floridarevenue.com/property/Pages/Home.aspx

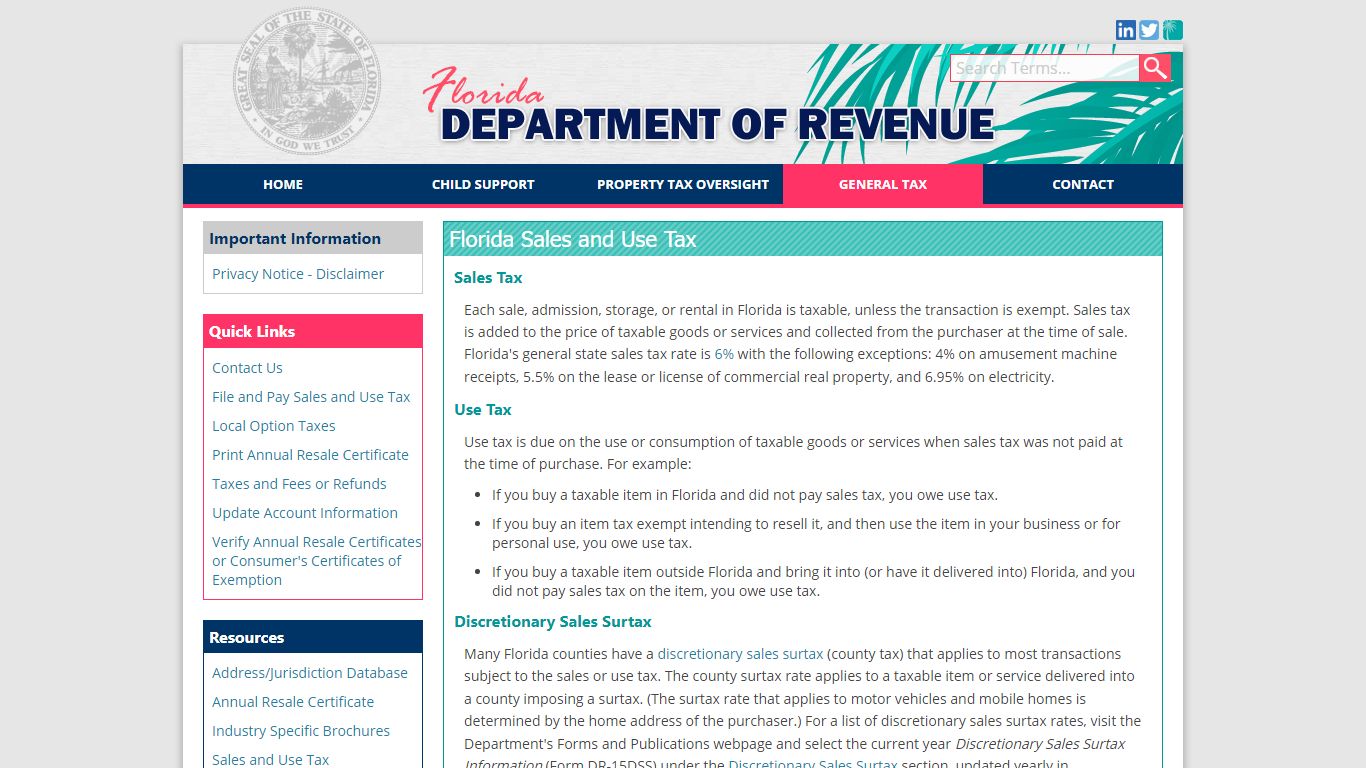

Florida Dept. of Revenue - Florida Sales and Use Tax

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6% with the following exceptions: 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity.

https://qas.floridarevenue.com/taxes/taxesfees/Pages/sales_tax.aspx

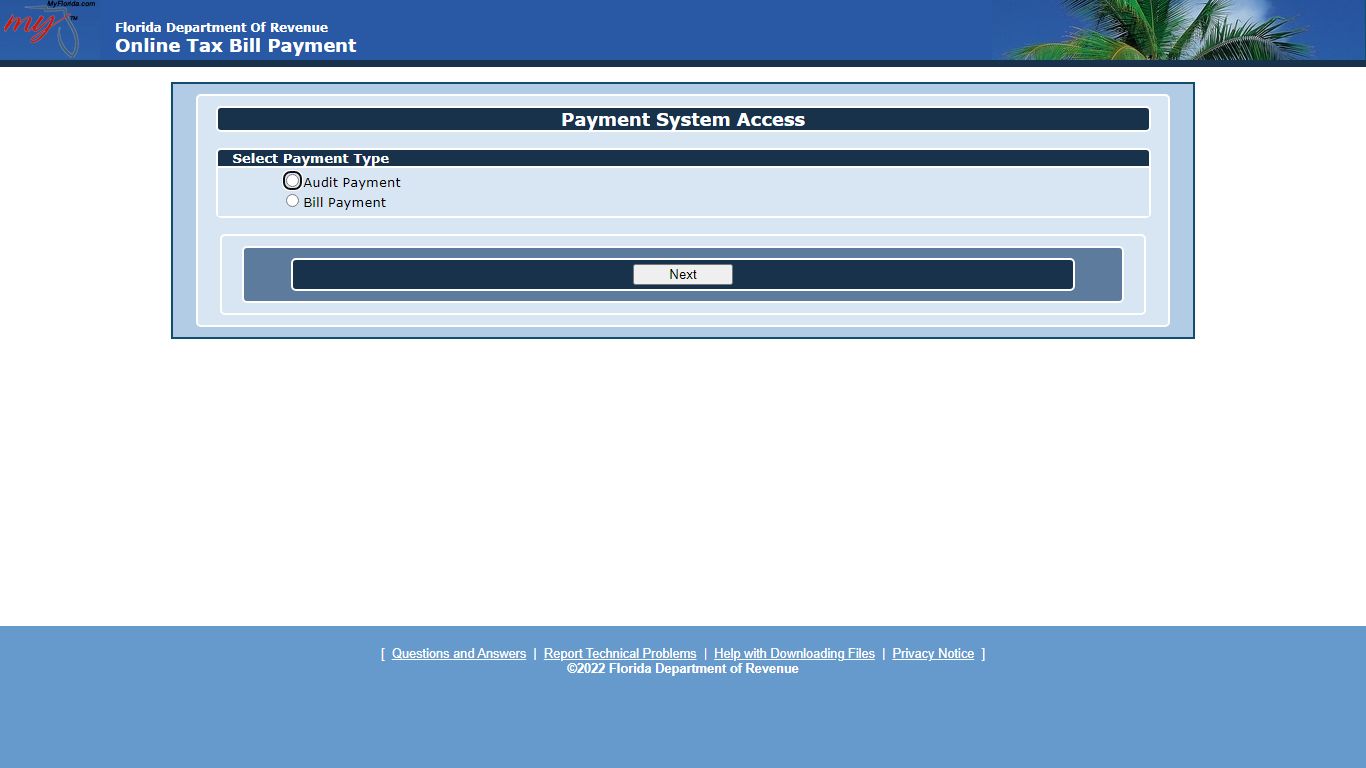

Florida Department Of Revenue | Online Tax Bill Payment

Online Tax Bill Payment Payment System Access. Select Payment Type

https://taxapps.floridarevenue.com/OnlineBillPayment/

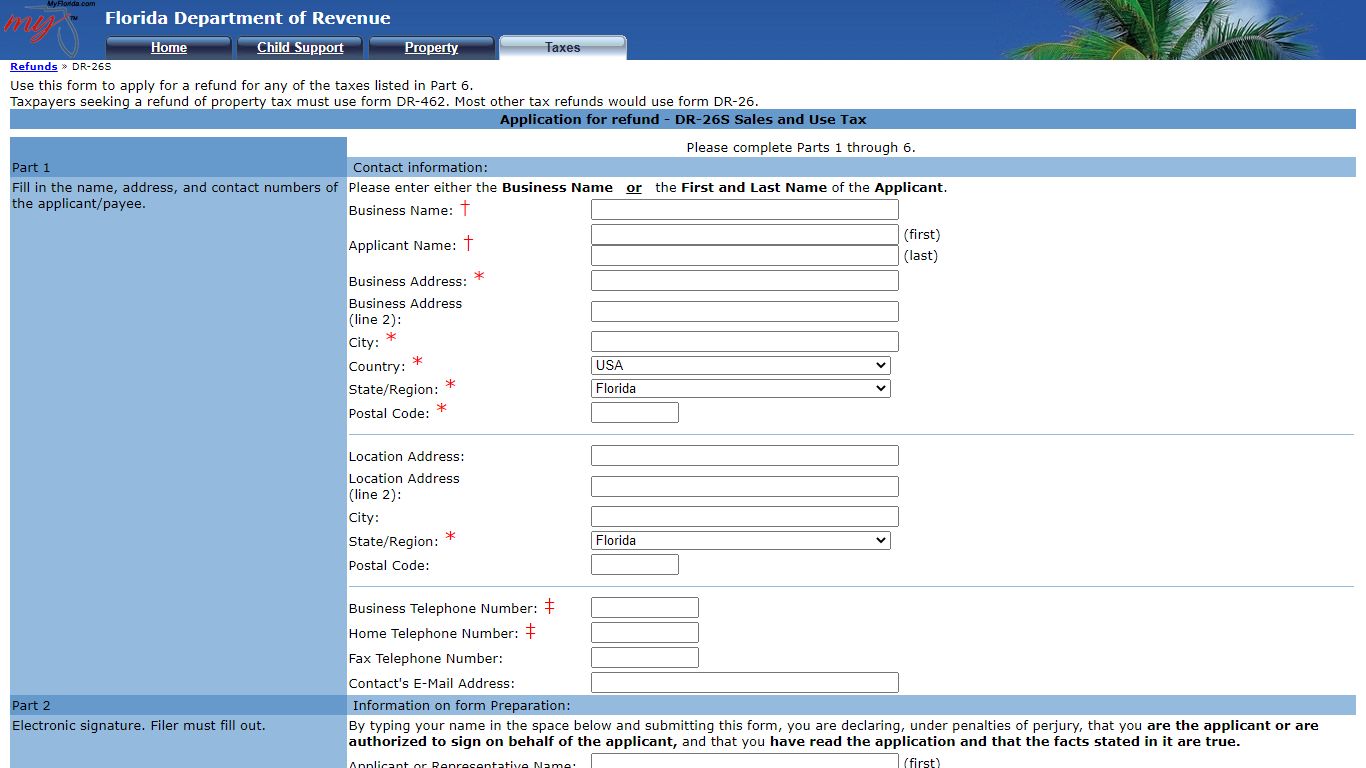

Florida Department of Revenue - floridarevenue.com

Florida Department of Revenue Refund Sub-Process PO BOX 6470 Tallahassee, FL 32314-6470 Fax: 850-410-2526 For further information regarding the DR-26S, the documentation required to process the refund, or to check on an application after it has been submitted, call us at 850-617-8585.

https://taxapps.floridarevenue.com/Refunds/DR26S.aspx

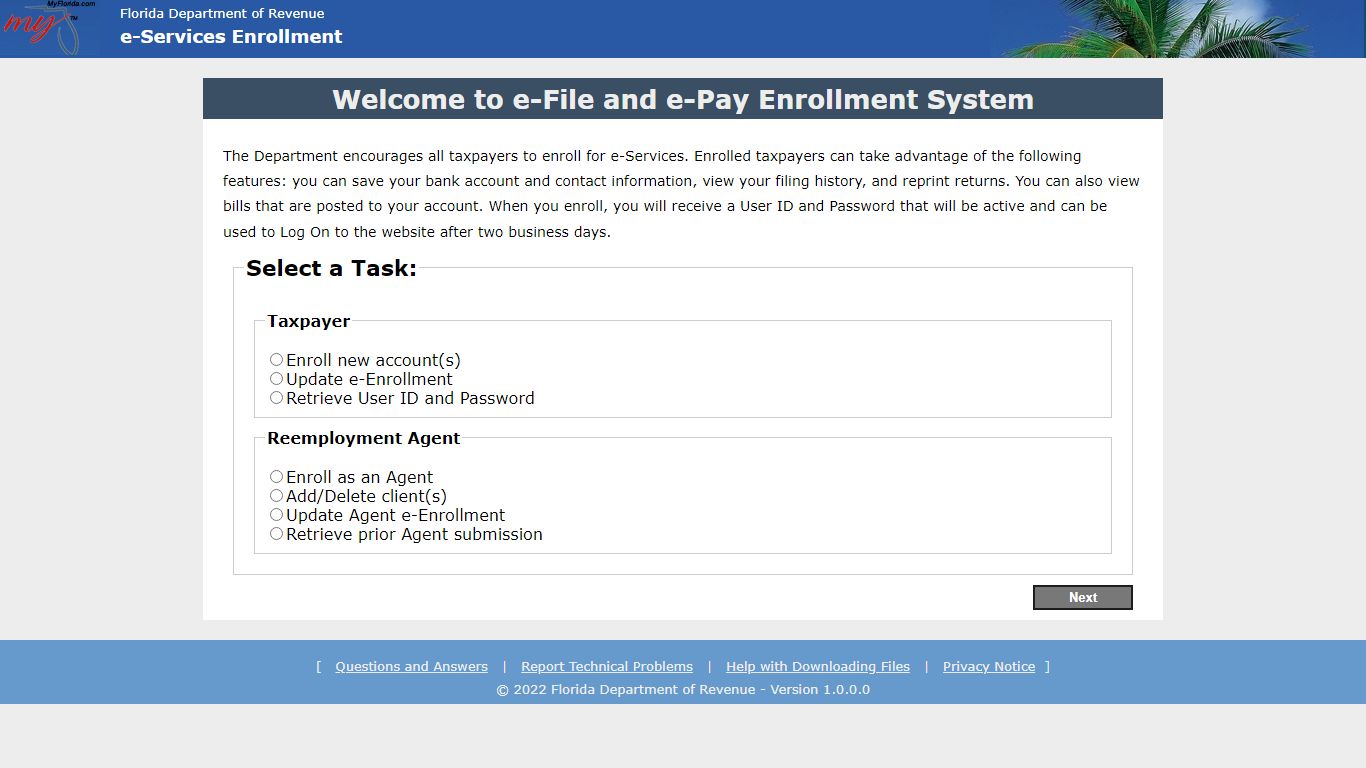

e-Services Enrollment - floridarevenue.com

Welcome to e-File and e-Pay Enrollment System. The Department encourages all taxpayers to enroll for e-Services. Enrolled taxpayers can take advantage of the following features: you can save your bank account and contact information, view your filing history, and reprint returns. You can also view bills that are posted to your account.

https://taxapps.floridarevenue.com/EEnrollment/